Eckoh launches new embeddable payments solution

News & Insights

23 Jul 2024

News & Insights

23 Jul 2024

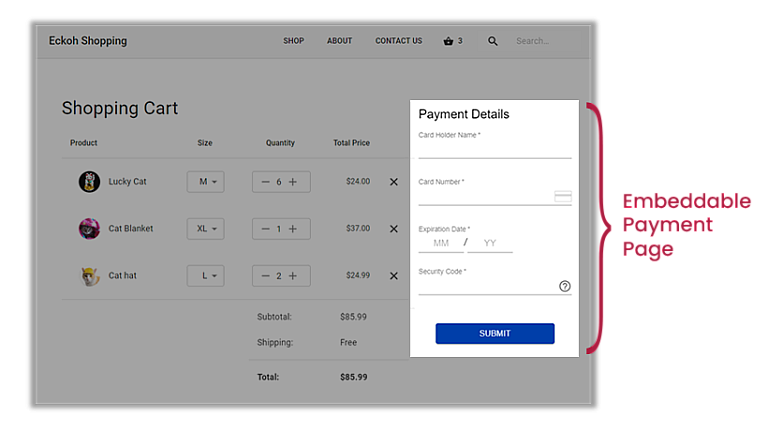

We are pleased to announce the launch of our new embeddable payments platform

April 2024, Eckoh plc (AIM: ECK) the global provider of Customer Engagement Data Security Solutions, has launched a new embeddable payments platform, continuing to help its clients to meet the challenge of taking payments securely in a digital world.

The embeddable payments solution is a crucial part of Eckoh’s Secure Digital Payments solution – allowing end customers who engage with a contact center, the freedom to combine their preferred contact channel with their favorite payment method. They may choose Apple Pay over the phone, Pay by Bank via live chat, card payments over social messaging, or a wide variety of other combinations.

Embeddable Payments takes this one step further, allowing clients to secure digital payments and traditional payment cards via all these channels from within their own website. Moreover, as with the full suite of Eckoh’s products and services, this means the client’s PCI-DSS compliance scope and risk of fraud are minimized by removing sensitive data from their environment.

Eckoh has recently worked with Chumash Casino Resort to implement its embeddable payment page into Chumash’s website and booking tools.

Mark Kris Badal at Chumash Casino Resort says:

“We needed to secure payments across all our contact channels, so we implemented both Eckoh’s embeddable payments page and CallGuard solutions on our websites and call centers. Being able to take all our compliance solutions from a single vendor simplifies our solutions, gives us a single robust support model, and makes supplier management easier.”

Ashley Burton, Head of Product at Eckoh, says:

“We are seeing the move to digital payments gathering pace as end customers choose to pay through a range of e-wallets and other digital channels. Our embeddable payments solution plays a critical role in our wider secure engagement suite of solutions; designed to remove sensitive personal and payment data from contact centres and IT environments and allowing our clients to satisfy all their payment requirements from a single vendor."