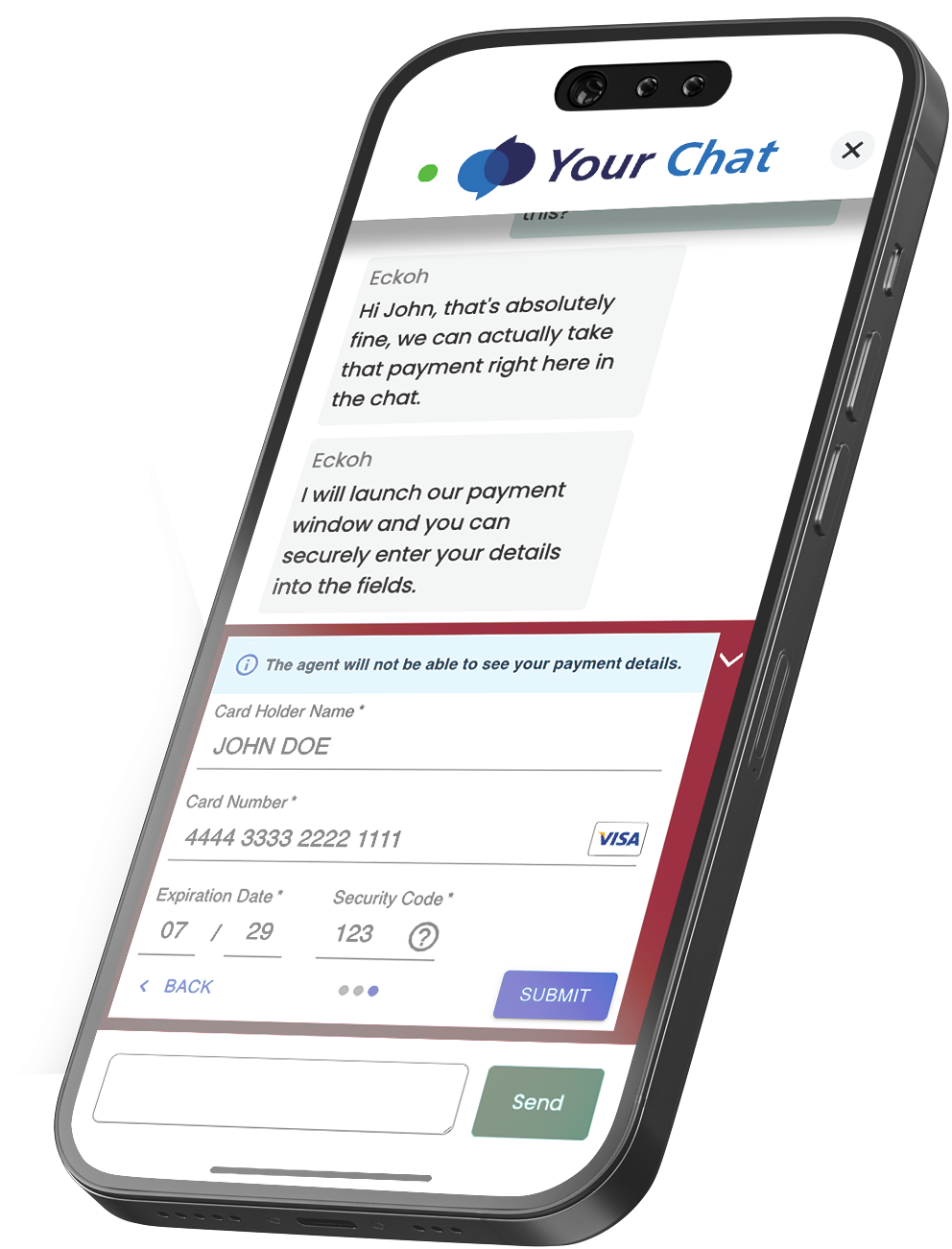

Customers love using chat. Now your team can take their payments or request personal data securely and instantly inside the same window.

It’s a faster, smoother experience – without the hassle of being sent off to a separate web page. Customers are more likely to complete transactions. ChatGuard also gives them a secure and convenient way to enter Personally Identifiable Information (PII)securely – which could be used for onward verification and access to accounts and a more personalized service.

Simply add ChatGuard to your existing chat application. You can also enable 3D Secure (3DS) for extra authentication as well as giving customers the option to pay using Apple Pay, Google Pay, PayPal or other digital payment methods.

All the sensitive details that customers type in the chat session are hidden from agents and stay secure and compliant with PCI DSS 4.0.